Carbon Markets 101:

Can voluntary carbon markets change the game for climate change?

Source: RaboResearch

March 16, 2021

by Daniël Poolen and Karolina Ryszka

Key takeaways

CO2 and other greenhouse gas emissions, in combination referred to as CO2 equivalent emissions or CO2e, are warming up the earth, changing the climate and are already causing damage to people, livelihoods and economies. The Paris Climate Agreement from 2015 aims at limiting the global temperature rise to 1.5 degrees Celsius in order to minimize (future) climate-related damage. Zero emission cannot be achieved as emissions from some processes are unavoidable (e.g. in agriculture). In other words negative emissions are needed in order to achievethe goal of the Paris Climate Agreement, negative emissions are needed. A negative emission is the removal of greenhouse gases from the atmosphere by deliberate human activities, i.e., in addition to the removal that would occur via natural carbon cycle processes (IPCC,2019).

In this publication we focus on the compensation of emissions by means of carbon credits, which are gaining in importance as an instrument to transition to a zero-carbon economy. Carbon credits are created in projects where actors implement activities resulting in lower or negative emissions. These credits can be sold by the actor who implemented the carbon reduction and can be traded and purchased by other actors, e.g. companies, to ‘compensate’ for their emissions. The motivations of the actors purchasing these offsets might be to comply with emission standards or regulations, to voluntarily improve their carbon footprint, or to support decarbonization projects. Individuals can also buy carbon credits, e.g. for planting trees to compensate their flight tickets.

The current market for voluntary credits is dwarfed by compulsory carbon markets and prices for voluntary credits remain at a low level. Over the past years voluntary crediting mechanisms have gained pace and are growing. Will voluntary carbon markets become a relevant mechanism in the fight against climate change? To answer that question this report looks at the development of voluntary carbon markets in recent years and gives an outlook with respect to their future development.

Emitting carbon into the atmosphere is what economists call a ‘negative externality’: it is a by-product of economic or other activity that creates damage now and in the future. Companies and consumers do not pay (enough) for these negative externalities and are therefore emitting too much carbon. This is a market failure – the market by itself does not internalize the costs of these emissions and so collective action is needed to obtain the socially desired result. In economic theory, carbon pricing is the solution for such an external effect. This can be done by either introducing a tax on carbon or introducing a marketplace for allowances to emit carbon.[1]

We can distinguish between compliance and voluntary markets. Carbon markets can trade either quotas or credits. Allowances are units of quota issued by the government, or tradable, bankable entitlements to emit pollutants. An example is the European Emission Trading System (EU ETS).

Credits are certificates created when a person or an entity underutilizes a ‘right’ to pollute or creates an opportunity to capture carbon. For more information on compliance markets, voluntary markets and market volumes, see Appendix 1.

Historically, different carbon crediting mechanisms evolved for different purposes. One can distinguish between three categories of voluntary crediting mechanisms:

In this article, we focus primarily on the third. For more information on the different types of crediting systems and how they work, see Appendices 2 and 3.

International crediting mechanisms used to be the most important crediting mechanisms, with most of the demand stemming from compliance with the Kyoto protocol which was enforced in 2005. The credits have been used primarily by regulated entities in industrial countries to reach their emission reductions commitment, e.g. by companies in the EU ETS. Clean Development Mechanism (CDM) is the largest credit issuer to date, with more than 50 percent of credits ever issued; Joint Implementation (JI) is the second largest issuer with 22 percent of all credits ever issued. Crediting activities increased until 2012 (the end of the first compliance period of Kyoto), before crashing in 2013 due to the lack of demand from EU ETS sectors following the financial crisis and to an oversupply of EU allowances (World Bank, 2020).

Since the end of the first Kyoto compliance period, these international crediting mechanisms have been losing their importance. Governments began to recognize voluntary standards for their compliance markets and to enter the voluntary carbon markets as buyers (Ecosystem Marketplace, 2019). Moreover, the future of international crediting mechanisms became uncertain under the Paris Agreement in 2015 (see Box 1).

Article 6 of the Paris Agreement

Article 6 of the Paris Agreement is supposed to provide flexibility to governments in implementing their Nationally Determined Contributions (NDCs) through voluntary international cooperation which should make it easier to achieve reduction targets. The idea is that countries with low emissions would be allowed to sell their [excess?] allowance to larger emitters, with an overall cap of greenhouse gas (GHG) emissions, ensuring their net reduction.

However, accounting for voluntary offsets that are executed in one country but purchased in another remains a contentious issue. The Paris Climate Agreement stipulates that emission reductions transferred internationally under the agreement must involve a “corresponding adjustment” to the national inventories of both the exporting and importing countries. The agreement is ambiguous on the international transfer of voluntary offsets, however, and participants are divided over how to treat them.

Some argue that it is wrong to call internationally-transferred reductions “offsets” unless there is a corresponding adjustment to the national accounts of both countries involved. Others argue that such an adjustment is unnecessary in voluntary markets as long as the unit being transferred is not entered in the national inventories of both countries.

There has been a surge of independent crediting mechanisms in the past years – they were responsible for 65 percent of the annual credits issued in 2019, compared to only 17 percent in 2015. Regional, national and subnational crediting mechanisms are also gaining importance (State and trends of carbon markets, 2020), since more regional, national and subnational carbon pricing initiatives are being set up.

Over the years, the situation on the carbon markets has been one of oversupply of credits – accordingly, the average prices have dropped almost every year since 2008 (from USD 7.3 per ton CO2e to around USD 2.7 in 2019), resulting in decreasing market value (Figure 1), despite relatively stable demand for credits (World Bank, 2020).[2]

Figure 1: Volume and price of voluntary carbon offsets

Source: Based on data provided in Ecosystems Marketplace, 2020

It should be noted that, despite the relatively low carbon price[3], the prices differ widely depending on the project category and even within a project category. The lowest average prices are paid for renewable energy projects (USD 1.4 /ton CO2e), whereas projects in forestry and land use see the highest average prices (USD 4.3 /ton CO2e). The lower average prices from 2019 can be attributed to cheap carbon credits from old renewable energy projects, i.e. from 2016, 2017. In 2019, prices for offsets from renewable energy decreased by 16 percent while their volume surged by 78 percent (Ecosystems Marketplace, 2020). These credits are cheap because their additionality is contested. For more information about additionality, see Box 2. Prices of new (nature-based) credits are actually rising: in 2019, prices for carbon credits from nature-based solutions and natural climate solutions rose by 30 percent (Ecosystems Marketplace, 2020). For more information on market volumes of carbon credits, see Appendix 4.

Box 2: What is additionality

How does crediting work in practice? Take, for instance, a project developer who wants to create carbon credits by preserving trees which are to be cut down in Brazil. The project designer needs to show the additionality of his project (without the projects the trees will be cut down) and present a plan to ensure that the carbon reduction is permanent, i.e. he needs to put management practices into place which ensure that the trees will not be felled in the years to come. He also needs to present a methodology to calculate the emissions reduction from his activity – which can be tricky, depending on the size and age of the trees and their location. Third-party auditors need to validate the assumptions regarding methodology, permanence and additionality. Some crediting authorities also require the project developer to show that his activities have co-benefits, e.g. positive effects on biodiversity, or, at least, do not cause harm, e.g. to the lives and livelihoods of the local population.

After project implementation, the greenhouse gas mitigation needs to be verified by another audit process. Registries then issue the appropriate amount of carbon credits, which can be bought directly or via intermediaries, such as brokers or retailers, who actually take ownership of the credit before re-selling it. It can take multiple transactions before the end buyer choses to ‘retire’ the credit and to claim its impact. Such an end buyer could be a person who just purchased a plane ticket, wanting to offset the emissions related to the travel. Then the offset needs to be flagged as unsellable on the registry such that it cannot be re-sold any further.

To achieve additionality, the crediting programme needs to provide incentives for implementing activities to avoid or sequester emissions which would not have happened without the crediting programme. These credits are created voluntarily outside the scope of compulsory carbon pricing initiatives (i.e. in different companies, sectors or countries), which is a fundamental difference to allowances or credits in compulsory carbon markets. The voluntary carbon credits can be used in different ways: firstly, as ‘offsets’, to compensate for individual or organizational emissions.

After the demand side was driven by international climate agreements and demand from regulated markets, a shift occurred towards non-regulated, individuals and regulated demand from regional, national and subnational carbon pricing initiatives. This shift is not only due to a decline in international carbon credits, but is also driven by greater public attention to and concern about climate change.

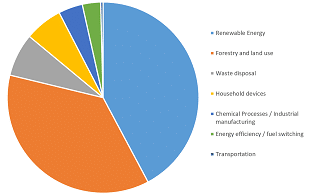

Figure 2: The volume of carbon offsets per project category in 2019 in Mton CO2e

Source: Based on data provided in Ecosystems Marketplace, 2020

These major crediting mechanisms tended to generate most credits from two or three sectors: 70 percent of CDM and JI credits came from projects in industrial gases, renewable energy and leaks or irregular vapors and emissions from sealed surfaces. The shift towards independent crediting mechanisms has also resulted in a shift towards more nature-based solutions: afforestation, reforestation and land-use. Offsets generated from forestry and land-use projects grew by 264 percent between 2016 and 2018, whereas the volume of other offset types grew by only 21 percent (Ecosystems Marketplace, 2019). The volume of offsets through renewable energy and forestry and land use are similar,. Figure 2 shows the volume of carbon offsets per project category in 2019.

The voluntary carbon credits market is rather small when compared to compliance markets and the balance between supply and demand has been hard to find due to credit oversupply. Which raises the question: is there a significant future at all for voluntary carbon markets?

There are indications that this could change in the future. In fact, there has been a steady upward trend in issuances and retirements in the last four years. Also, depending on the specific credit categories, the picture could look very different: as mentioned before, offsets generated from land-use activities grew disproportionally faster than the volume of other offset types. Higher demand could then ultimately result in price increases, thereby improving the business case for other carbon offset projects.

We see an optimistic scenario. Firstly, new emission trading systems are being set up worldwide, which increases the demand for regional credits. Secondly, demand will grow from non-regulated sectors. Large companies and governments tighten their CSR policies, including strategies to offset through carbon credits. From 2021 aviation is supposed to offset all additional emissions compared to a baseline. Aviation accounts for only about 2.5 percent of global CO2 emissions. Nevertheless, emissions are projected to increase strongly over the next years (Ivanovich et al., 2019). See below for details of the impact of Covid-19. Thirdly, there has been a rapid increase in credit issuances and retirements over the last couple of years (Figure 3; Ecosystems’ Marketplace, 2020). This has been the case for nature-based credits in particular. If this growth continues, the market will double in the coming two years.

The Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) is developed by the International Civil Aviation Organization (ICAO) and adopted in October 2016, its goal is to have carbon-neutral growth from 2020. The scheme is voluntary and is supposed to work until 2035 at least. The total demand for those 15 years is estimated at 2,700 Mton CO2eq offsets (Ecosystem Marketplace, 2020b). Ecosystem Marketplace found that there are currently more than enough carbon offset supplies to meet initial demand under CORSIA. Yet some market experts predict possible shortages of supply for offsets generated by removing carbon instead of reducing emissions. Ratings agency Fitch projects that offset demand will surpass supply by around 2025.

There is a trend of large companies making zero-carbon pledges, even in the course of 2020 (Ecosystems marketplace, 2020). The Climate Ambition Alliance launched its “Race to Zero” campaign to encourage countries, companies, and other entities to deliver structured carbon-neutral pledges by the end of 2021, ahead of COP26.

Figure 3: Annual voluntary carbon offset issuance and retirements 2007 -2019

Source: Ecosystem Marketplace (2020)

Covid-19 has disrupted many aspects of life and the economy. It also has an effect on the carbon offset market, especially with respect to offset demand from air travel. CORSIA design features, such as the baseline against which additional emissions will be compensated, are to be changed due to the pandemic’s impact on the air travel industry. Instead of using both 2019 and 2020 emissions as the baseline for the pilot phase starting in 2021, only 2019 emissions will be used to “safeguard against inappropriate economic burden of aeroplane operators” (CORSIA, 2020). Covid-19 might have a long-term effect on the air travel industry and it may take another few years before the air travel industry recovers.[4] This might curb the carbon offset demand in the short to mid-term future.

Although 2020 has been described as a“year of resilience” (Ecosystem Marketplace, 2020) as demand for carbon offsets was not halted in the first few months of 2020 despite Covid, the question is whether demand will keep up if we find ourselves in a longer-term economic slowdown or recession.

There has been much criticism of carbon offsets in the past: there have been examples of greenwashing by companies and projects that violate their stated best practices. This needs to change if carbon offsets are to play a major role in bringing about decarbonization. Companies need to be educated on the responsible use of carbon offsets. Offsets should not be treated as an alternative to reducing emissions, but as a means to offset the unavoidable emissions. They should only be used temporarily, to avoid delaying transition to a low- or zero-carbon sector (UNEP, 2020). The Science-Based Targets Initiative (SBTi) released its guidance for using offsets as part of a robust corporate emission-reduction program, contributing to a growing debate over what “carbon neutrality” is and is not. There have been efforts to strengthen the carbon offsetting methodologies in recent years under ICROA. For more information on ICROA see Appendix 3. Nevertheless, there is still scope for further transparency and standardization.

Further standardization would also help to increase the size of voluntary carbon markets. To deliver carbon neutrality or negativity at the scale needed to achieve the Paris Agreement targets, carbon offsets must not only generate verifiable emission reductions; they must also evolve beyond a series of bilateral over-the-counter transactions into a real, functioning market. That is the goal of a new global task force launched in September 2020 by former Bank of England Governor Mark Carney. The effort aims to promote standardization and liquidity in voluntary carbon markets with the goal of increasing its size exponentially – perhaps more than 150-fold.

Relatedly, the costs of monitoring, auditing and certification need to decrease substantially. For many projects, these costs are still a bottleneck and hinder the lift-off of these projects.

So far, the supply side of carbon credits has been very decentralized. Developing projects individually and navigating the crediting process individually may not be sufficient to cover a substantially increased demand in the future. One way to meet demand is to move beyond carbon credits generated from individual projects and into those generated by supporting jurisdictional efforts. Jurisdictional programs could help take the tropical forest agenda to scale, for instance, addressing systemic drivers of forest loss across large territories. Some jurisdictions are also preparing to offer carbon neutral commodities, like soybeans.

Several important developments have been observed in voluntary carbon markets over the past 5 years and there is potential for future important changes. Demand has shifted from compliance with the Kyoto protocol and carbon credits generated through industry, waste and renewable energy projects to carbon credits from nature-based solutions demanded by unregulated companies and individuals. There is a chance that these trends will continue in the future, with air travel companies planning to offset their additional emissions and big companies making zero-carbon pledges. This additional demand might decrease the oversupply of credits and finally raise offset prices, making more expensive projects viable. Yet, such a positive outcome is far from certain, given the possible longer-term impacts of the current Covid-19 crisis and the structural need for further standardization in carbon crediting methodologies and accounting.

Carbon offsetting on a voluntary basis could be a game changer, providing funding to projects that avoid and remove carbon from the atmosphere. Yet there is scope to improve transparency of various carbon crediting mechanisms and a need for standardization of crediting and accounting. This would enhance customer trust in the offsets offered, result in higher market volumes and a real, functioning market. Large customers, like airlines and other companies, but also national and supranational governments should demand more standardization and regulation of this market.

There are 61 carbon pricing initiatives in place worldwide or scheduled for implementation (World Bank, 2020), of which 31 are compliance carbon markets. In compliance carbon markets (which can be on the international, national or regional level), a couple of (often) large or industrial emitters are required by law to comply with a limit on the amount of greenhouse gases they can emit. The limit can be introduced as an overall cap on the sector or as relative baseline on the emitters. Emitters can buy or sell allowances or credits depending on whether they produce more or less emissions than they are supposed to.[5] The EU ETS market is the world’s largest carbon market by volume and value, and the carbon price has been above EUR 30 euros/ton CO2e since 2019, apart from a drop during the Covid-19 crisis. Since November 2021 the carbon price has been above EUR 40 /ton CO2e.

Voluntary carbon markets are often non-governmental initiatives which issue tradable emission units to actors who voluntarily implement emission reduction activities. This is in contrast to compliance markets such as ETS, where actors either reduce their emissions or pay for the surplus. These voluntary crediting units can be used in regulated schemes, such as carbon taxes or ETS, if policymakers choose to give the regulated emitters an alternative means of compliance.

Voluntary crediting units can also be traded and purchased by other actors, e.g. companies, to ‘compensate’ for their emissions, as mentioned earlier. One example of such a compliance mechanism for voluntary carbon credits was the Clean Development Mechanism (CDM) credits in the EU ETS scheme. They made the EU ETS the biggest source of demand for international credits, but the use of these credits was limited during the last EU ETS phase (2013-2020).

There are two international crediting mechanisms: the Clean Development Mechanism (CDM) and the Joint Implementation Mechanism (JI). Both were established in 1997 under the Kyoto protocol and are responsible for almost three-quarters of all credits issued to date. The CDM crediting mechanisms allowed emission reductions to be transferred from non-Annex I countries, i.e. ‘developing’ countries, to Annex I countries, i.e. ‘developed’ countries. The JI crediting mechanism worked in a similar way, but was limited to Annex I countries and economies in transition, e.g. Russia.

Independent crediting mechanisms generate credits which are mainly used for voluntary offsetting purposes of both organizations and individuals and are responsible for most of the credits sold for voluntary offsetting. As mentioned before, some independent carbon credits can also be used in certain compliance markets. There are many independent crediting mechanisms, but there are four major ones:

There are currently 17 crediting mechanisms and five more are in development (World Bank, 2020).

Carbon crediting is “the process of issuing tradable units to actors that are implementing approved emission reduction activities” (World Bank, 2020, p. 47). These emission reduction activities need to result in lower emissions than in a counterfactual scenario where there is no carbon crediting.

The crediting is taken up by a crediting authority. Common standards for these crediting authorities only started to appear in the early 2000s with the International Carbon Reduction and Offset Alliance (ICROA) setting the standards for many leading crediting authorities and offset providers. ICROA’s members commit to its code of best practices and to use carbon credits that are:

Carbon credits used for offsetting reasons can be used for different purposes:

The volume of the voluntary carbon market in 2019 was 104 Mton CO2e with a market value of USD 282.3 million, and an average price of USD 2.7 /ton CO2e (Ecosystem Marketplace, 2020). The voluntary carbon market is hence dwarfed by existing compliance markets: USD 48 billion was raised in carbon revenues in 2019 (both carbon taxes and ETS). The global Emissions Trading Systems account for 47%, a total of USD 23 billion. More than 3,000 Mton of CO2e are already covered on compliance markets.

Figure 4: Emissions priced in compliance versus voluntary carbon markets

Source: Ecosystem Marketplace (2020) and World Bank (2020)

China launched the Chinese ETS in early 2021, covering 2,225 power generating companies. Another 3,000 Mtons of CO2e are projected to be covered as the Chinese ETS expands over time, amounting to around 10% of the global emissions covered by compliance markets.[6] It should be noted, however, that the emissions covered by compliance markets are still being emitted, only with a price. In contrast, the Mtons CO2e traded in voluntary markets are emissions which are indeed avoided , i.e. not emitted in the first place, or withdrawn from the atmosphere. The literature on the effects of the EU ETS on actual emissions reductions is inconclusive.[7] From 2021 onwards, the overall number of emissions allowances will decline at an annual rate of 2.2% (EU Commission) which equals emission reductions of 55 Mton in 2021. This is already in a similar order of magnitude as the avoided or sequestered emissions from the voluntary carbon offsets.

[1] In another publication (in Dutch only), we looked at length at the (empirical) evidence regarding carbon taxes and compulsory carbon markets.

[2] Unlike compliance credits and offsets such as those traded under the European Union’s Emissions Trading Scheme (EU ETS), most voluntary offsets are transacted bilaterally and over-the-counter, with no centralized repository for price and volume data. The data shown is based on publications by Ecosystem Marketplace, which gathers this fragmented data by reaching out to all known market participants and by conducting bilateral interviews with market experts.

[3] Information is based on a market survey by Forest Trends’Ecosystem Marketplace. There are bi-lateral agreements on carbon prices that are significantly higher and might not be included in this dataset.

[4] See the scenarios for the Dutch air travel sector (SEO, 2020), where passenger numbers are estimated to be up to 70 to 80 percent lower in the coming years.

[5] There are two ways to implement these limits: by introducing a cap-and-trade system or a baseline-and-credit system. In a cap-and-trade system, a maximum allowed emission cap is established and emission allowances are allocated to emitters, which can be traded amongst the emitters. In a baseline-and-credit system, emission baselines are set for emitters. Emitters which emit more than their baseline need to buy credits for these extra emissions, whereas emitters below the baseline receive credits which they can sell to other emitters.

[6] The volume of emissions covered by a carbon pricing initiative (both ETS and carbon tax) amounts to 12,000 Mton CO2e, corresponding to 22% of global greenhouse gas emissions.

[7] EU ETS prices have, so far, not been effective in reducing CO2 on a large scale. Empirical evidence on the effectiveness of the scheme is mixed at best. Possible reasons for low effectiveness of the system encompass low prices (European Commission, 2013; Koch et al., 2014), the overallocation of allowances (Clean Energy Wire, 2018), and the fact that the vast majority of allowances was allocated for free (ICAP, 2020). Emission reductions in the affected sectors are explained by increasing energy efficiency improvements and by the 2008/09 economic crisis (Bel & Joseph, 2015; Aldy & Stains, 2012). The planned coal phase-out in several EU countries is a political decision rather than an economic one.

Tags: International, Sustainability, Energy Transition, Innovation, Eurozone, Asia and Oceania, North America, Latin America, Germany, Spain, France, United Kingdom, United States, India, Netherlands, China and Hong Kong, Japan, Italy

Source: RaboResearch

Return to the pathway to build your knowledge of Carbon Markets

Return to Pathway